US banking bailout

Global finance crisis deepens

Take the banks out of private hands!

|

|

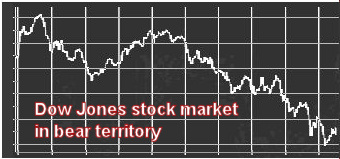

Dow Jones plunges: dark days for the stock market |

THE REAL rate of inflation that workers in Britain face has hit 18.5%, according to the Daily Mirror, as the cost of food, fuel and household bills continue to rocket. Simultaneously with prices spiralling upwards, the economy is entering recession.

Hannah Sell

House prices are falling at the fastest rate ever recorded according to the Halifax. Unemployment is on the rise, with tens of thousands of jobs in the construction and finance sectors already gone.

But, bad as things are, this crisis of British capitalism is only just beginning. For a glimpse into our future it is only necessary to look across the Atlantic, to the nightmare unfolding in the biggest economy in the world, the US.

IndyMac, the Californian mortgage-lending bank collapsed on Friday. It was the biggest American lender to fail in more than two decades. US regulators are expecting dozens more banks to hit the wall over the coming year. However, it is the threatened collapse of Fannie Mae and Freddie Mac, the US’s two largest mortgage finance companies that is striking terror into the hearts of US capitalism.

Last Sunday the Bush administration asked the US Congress to approve an emergency rescue package to prevent the collapse of Fannie and Freddie, which together guarantee more than $5,300 billion in US mortgages, almost half the US mortgage market.

As the International Herald Tribune put it: “They [Fannie and Freddie] are too big to fail…If they go down, so do whole neighbourhoods. So perhaps, does the global financial system.” There is no ‘perhaps’ about it. The failure of Fannie and Freddie would result in an economic tsunami that would make the global aftershocks of the ‘sub-prime’ crisis look like a storm in a teacup.

As a result, the present political representatives of US capitalism, the neo-con free market zealots who spent the last decade warning the world’s governments against the evils of state intervention, have been forced to propose that Congress extends a limitless line of credit to Fannie and Freddie.

They have also promised to step in and buy a stake in Fannie and Freddie should the crisis get worse. Like the earlier rescue of Bear Stearns bank, the risk has been nationalised, while future profits remain in private hands.

The Financial Times, representing the views of much of finance capitalism, argued in its editorial for outright nationalisation, saying: “It would be a cosmetic change; the government is already backing them; it is absurd they are not now on the books.”

Capitalism does not work. Its representatives are being forced to turn to state intervention on a huge scale to prop up their system.

Of course, capitalist governments are intervening, not so that workers have a home, a job, a pension, or a living wage. On the contrary, both the Bush and Brown governments are trying to force the working and middle classes – via wage cuts and unemployment – to bear the brunt of the crisis.

Meanwhile speculators and hedge fund managers are still raking in billions by betting on where the economic tsunami will hit next.

The Socialist Party demands genuine, socialist nationalisation of the banks and mortgage lenders, not in the interests of big business, but instead run in the interests of society under democratic workers’ control and management, providing, for example, cheap and secure mortgages. Compensation should not be paid to the fat cats and rich speculators; it should only be paid on the basis of proven need.