|

|

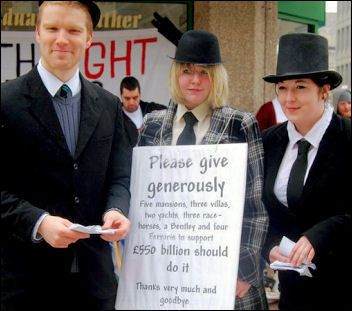

London’s Waltham Forest Socialist Party campaigns against bankers’ bonuses and bailouts, photo Senan |

Less than a year after bringing the global economy to its knees, shameless city bankers are to receive a staggering £4 billion in bonuses. These vultures, who had pledged to end the bonus culture, are now lining up for massive pay-outs.

Elaine Brunskill

Chief executives from Barclays and HSBC have compared their pay-outs to the money made by footballers and Hollywood stars. How gullible do these individuals think we are? It would be more accurate to liken them to criminal gamblers who are happy cashing in when they’re on a winning streak, knowing that if they lose they will go out and steal from someone.

RBS, having received a £20 billion bailout, is giving its chief executive, Stephen Hester, a whopping £9.7 million – despite a £1 billion first-half year loss!

John Varley, Barclay’s chief executive, was reported as saying that because of the bank bailouts he would be “sensitive to the views of citizens”. 24 hours later, details emerged of massive bonuses. The ‘three big guns’ at Barclay’s investment division, Barclays Capital, are being guaranteed two years’ worth of bonuses.

Similarly, in 2008, nine US banks that received federal bailouts paid out an astounding $33 billion in bonuses. This included Merril Lynch that paid out $3.6 billion, even though it received government aid and made a loss of $27.6 billion!

Though it was City and Wall Street bankers who worsened this crisis, it is ordinary workers who are paying the price. The Bank of England’s latest attempt to kick-start the economy with a massive £50 billion extension of quantitative easing (printing or electronically generating money) shows how deep the crisis still is.

Youth Fight for jobs campaigning in Cardiff against the bankers bailouts and bonuses, photo Cardiff YFJ

Tens of thousands of workers have already lost their jobs and many more fear that theirs will follow. Home repossessions are at their highest level since 1992. Insolvencies (bankruptcies, IVAs and debt relief orders) could top 125,000 this year, almost double the number of 2005.

Looking at some of the revived profits for investment bankers the Financial Times stated: “A near-death experience rekindles one’s appreciation of life. So too for banks: survivors of last year’s collapse are now in clover again. But cheating death may prove easier than pacifying the public”. This reflects a growing fear among sections of the capitalist class that more city bonuses will stoke rising political and social tensions.

The rich are still grabbing what they can, but for the majority of people, even when recovery eventually comes, it is expected to be insipid and protracted, bringing no quick relief. With this prospect, the biggest task facing workers is the creation of a new mass workers’ party which could act as a catalyst and conduit for the fightback against the bosses and their unscrupulous banking friends in the city.

Workers facing the prospect of job losses and wage freezes will be infuriated by the return of the ‘masters of the universe’. Bankers, who received a collosal £37 billion bailout of public money to keep them afloat, once again strutting around with wallets bulging from their bonuses. All this is setting the scene for an autumn of discontent.