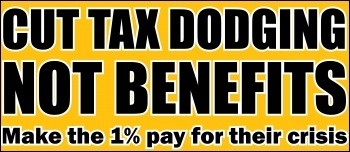

Make the 1% pay for their crisis

Sophie Brooks

I should be looking forward to becoming a first-time mum this year. Instead I’m looking over my shoulder at crumbling services and decimated benefits.

These cuts are going to leave our family and millions of others with tough choices unless we do something about it.

The Con-Dems say we are scroungers, shirkers and skivers – hardworking taxpayers shouldn’t have to stump up so much money to help ‘us’.

They say we need to cut back on our ‘luxuries’ and try to make ‘us’ feel guilty for needing help with our housing costs, our childcare and our food and utility bills.

But who are ‘us’? ‘Us’ are workers whose wages don’t meet even a basic standard of living – 93% of new housing benefit claims are from working households. ‘Us’ are the 2.49 million unemployed fighting it out for 489,000 vacancies.

And ‘us’ are the disabled, elderly and most vulnerable who look to the state for help.

Bedroom tax

This April the correctly maligned ‘bedroom tax’ and the changes to council tax benefits will be another blow to the poorest in society while the rich see income tax on their high earnings cut by 5%.

Housing Futures Research found that 42% of the 660,000 households to be hit by the bedroom tax already struggle financially.

A staggering 72% have disability and/or health problems. Yet the government wants to take 14% of your housing benefit if you are in social housing and deemed to have one ‘spare room’ and 25% for two or more.

This crazy attack will see people forced out of cheaper social housing because of a shortage of single bedroom properties, and into the private sector where soaring rents will mean their housing benefit claim actually rises!

Council tax benefit

The government is also handing council tax support responsibility to local councils while cutting funding by 10%. Some bills will rise by £600 a year.

Over 74% of councils say they’ll now charge people whose incomes are so low that they don’t currently pay any council tax. The poorest working households could see a doubling of the amount they have to pay.

Not content with cutting corporation tax to 21% from April 2014, the government is making it easy for big business to cheat the system.

The 30 companies drafted in to help write new Controlled Foreign Company rules – that determine how companies can claim their business is in a tax haven even if their goods are sold here – have 3,000 subsidiaries in tax havens themselves!

While the government spends its time seeking to condemn, fine and sanction people over the 0.3% of benefits claimed fraudulently, more than £120 billion of tax continues to go unpaid, mainly by big business and the rich, every year.

The four biggest accountancy firms employ 200 high-paid staff in their ‘transfer-pricing’ departments to assist companies in getting around tax law.

The tax office, HMRC, employs a measly 65 over-worked staff to chase these criminals! These ‘big four’ also make £490 million annually from public sector work!

Them and us

The government says young people, the disabled, the low paid and the unemployed are leeches on society. Yet the fortunes of the super-rich 1% show that these cuts are not necessary.

The ten most expensive boroughs in London have a total property “value” of £552 billion, more than Wales, Scotland and Northern Ireland combined.

Big business has £800 billion locked away because they see no ‘profitable’ outlet for it.

This wealth should be used to fund the jobs and homes we need while stopping the attacks on benefits and services.

But for that to happen, resources need to be publicly owned under the democratic control of the 99%.