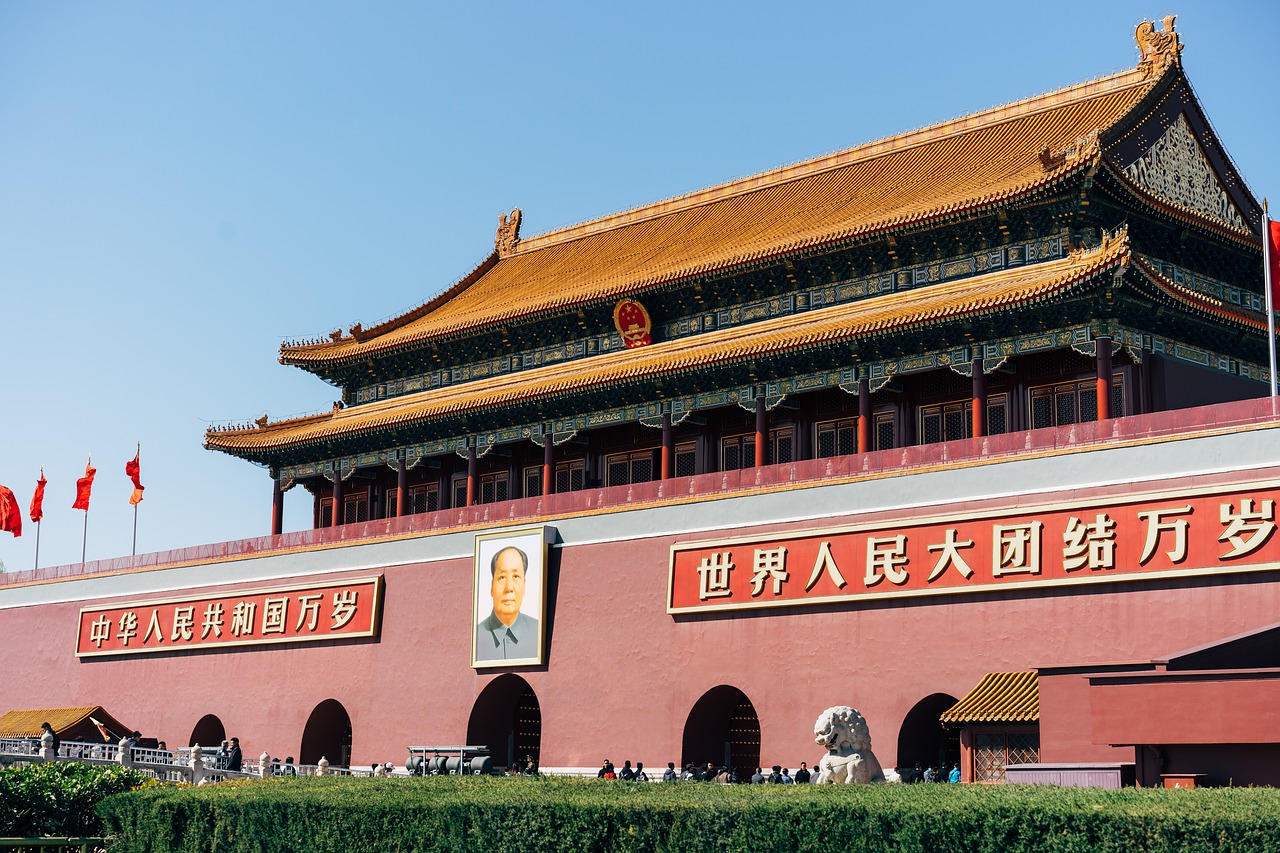

So-called ‘communist’ China has not created common prosperity and bears absolutely no resemblance to genuine Socialism

Hannah Sell, Committee for a Workers’ International international secretariat

At the start of October, the International Monetary Fund slightly downgraded its predictions for global economic growth, citing the continued pandemic and the slow progress in vaccinating the world as the major factors in doing so.

In addition, it raised concerns about inflation, disruption to supply chains, and growing international tensions. For China, however, they still predicted 8% growth in 2021. Nonetheless, it is clear that the next era will not be comparable to the period after the 2007-08 financial crash, when China acted as a prop for the world economy, albeit partially financed by the US Treasury’s underwriting of the world’s financial system.

This time around the increased conflict between US imperialism and China, combined with growing turbulence within China itself, means that China will be a factor adding to the multiple crises of global capitalism rather than temporarily ameliorating them.

Most recently, a number of major Chinese property companies have been teetering on the brink of collapse. Evergrande, the most indebted property developer in the world, was the first to hit the headlines, but it has been followed by others. Kaisa Group Holdings was the latest to suspend its shares on the Hong Kong stock market, after their value tumbled.

When the Evergrande crisis first erupted, the financial press was full of warnings that this could be a new Lehman Brothers (the US company whose 2008 bankruptcy was a trigger for the Great Recession). While the turmoil in the Chinese property sector continues, that has not, so far, come to pass. Now, the financial pages of the western press are debating a different problem. Some think that the moment of danger has passed, with China’s equity markets reaching their lowest point, and therefore now is the time to invest and make a fast fortune.

Others, however, fear “that government intervention will restart and roll into other sectors”, as part of, as the President of Queen’s College Cambridge put it in the Financial Times, “a bigger realignment of the Chinese economic and financial system fuelled by both internal and external considerations.”

Property bubble

This latest fear of Western capitalist investors in China is not groundless. For years China has had a gigantic property bubble, but the current turmoil was not triggered by its bursting. Rather the crisis in Evergrande and now the wider property sector – which accounts for 29% of Chinese GDP – began because of the Chinese state’s determination to curb the behaviour of the big property companies, trying to force them to stay behind its ‘red lines’, which are designed to try and reduce debt levels in the sector, and rein in soaring property prices.

The Chinese banking and finance system has strict capital controls, and is dominated by the state-owned banks, which could have bailed out Evergrande at any point. That they have not done so is clearly a decision of the Chinese regime. So, it seems, is the decision to – until now – make payments to international creditors. So far, Evergrande has not technically gone bankrupt, making each international payment in the nick of time. In comments clearly relating to the Evergrande situation, the Chinese state’s economic planning agency made clear that companies should pay what they owe globally, in order to “maintain their reputation and the order of the market”. This indicates the Chinese regime’s current desire to avoid causing international market turmoil. Meanwhile, behind the scenes in China, it seems that the state is moving to step in and redistribute the assets of Evergrande, which currently has 778 projects under way in 223 cities, with many would-be homeowners having paid for properties which have not yet been built.

In reality, the Evergrande crisis is one of a series of moves by Chinese president Xi Jinping and his regime to try to curb sections of the capitalist class. In 2017 the private insurance group, Anbang, was effectively shut down and forcibly restructured by Chinese regulators.

Last year the stock market listing of what was the biggest private company in China, the Ant Group, which was planned for $37 billion, was abruptly cancelled on the orders of the Chinese state, and the company ordered to restructure. Further limits put on the education, e-commerce, gaming, and other sectors are estimated to have lopped between $1.5 and $3 trillion off the stock market valuations of the firms concerned.

‘Common prosperity’

What lies behind these moves by Xi Jinping, which obviously carry risks at a time when the Chinese economy faces numerous difficulties? They are being linked to the current dominant slogan of the Chinese regime for ‘common prosperity’. Pressure is being exerted on China’s billionaires to give more towards so-called ‘common prosperity’. The founder of Tiktok has given $77 million to a state education fund. The founder of smartphone company Xiaomi went further, giving over $2 billion to a fund to eradicate poverty.

Last month, huge celebrations were organised to commemorate the centenary of the founding of the Chinese Communist Party. This month, the annual meeting of the so-called Communist Party’s central committee is discussing a resolution on the party’s history, focusing on the ‘crucial’ role of Xi in transforming China into “a great modern socialist nation.”

Yet so-called ‘communist’ China has not created common prosperity and bears absolutely no resemblance to genuine socialism. While individual capitalists are feeling the pressure to cough up pretty large sums of cash, and others have faced ruin, or even execution for corruption, China remains a country where the capitalist class can make vast profits. Overall, last year the total wealth of the 2,918 richest people in China increased by 24% to $5.3 trillion. The 1921 founders of the Chinese Communist Party would be appalled at the brutal dictatorship, presiding over one of the most unequal countries in the world, which claims to be descended from them.

Nonetheless, Xi’s ‘socialist’ rhetoric is not just a historical overhang from the past, in the process of fading away. On the contrary, it has increased under Xi’s rule, and has been stepped up again in recent months. The very peculiar character of the Chinese regime is, nonetheless, a product of its history.

The mighty 1949 revolution, based on the poor peasantry, overthrew landlordism and capitalism in China, establishing a planned economy which led to important gains for the working class and poor peasantry; particularly the ‘iron rice bowl’ (security of employment) plus education, health and welfare provisions provided by state-owned enterprises and village communes.

However, unlike in the Soviet Union, where the initially democratic workers’ state degenerated as a result of isolation and poverty, from the beginning the Chinese regime was not based on workers’ democracy but was a Stalinist bureaucratic regime. While defending the planned economy, the state was relatively independent, not subject to democratic checks by the working class.

In 1989 the Soviet Union began to implode. The bureaucracy had stifled every element of democracy. The dictatorship had always been an enormous fetter to the full development of a planned economy but had now become an absolute obstacle to taking society forward. The collapse of economic planning arose from the internal contradictions of Stalinism, not from the superiority of the market. On the contrary, the return to the market represented a counter-revolutionary regression to private profit-seeking and anarchy. Far from demonstrating its superiority, the advent of the market brought the biggest slump in modern times.

The Chinese regime watched the catastrophic and chaotic restoration of capitalism unfold in the Soviet Union and concluded that they would not make the same mistakes as the Soviet bureaucracy, which resulted in them being swept away and the once all-powerful Communist Party being banned. The Chinese regime also went down the road of introducing capitalist relations – on an enormous scale – but it attempted to do so in a controlled way, with the Chinese Communist Party state keeping its hands on the reins.

Three decades on, the Chinese state has – so far – been able to keep large elements of control. There is now an enormously wealthy capitalist class. China is home to 626 billionaires, second only to the US. The regime’s economic base is a unique form of state capitalism, in which the regime is not simply the repressive agent or servant of the, historically speaking, newly formed, Chinese capitalist class. The Chinese state has had a large degree of autonomy in fostering and steering the development of capitalism in a way that best preserves its own power. The ailing character of Western capitalism over recent decades has further encouraged the Chinese regime that they have a superior way forward.

Hybrid character

There is no exact historical comparison for the peculiar hybrid character of China today. However, Marx and Engels described the complex relationship between the state ‘superstructure’ and its economic foundations, and how, under certain conditions, a state power balancing between social classes (a ‘Bonapartist’ state) can for a period play an autonomous role in sponsoring the development of capitalist industry and fostering the development of a capitalist class.

However, the current situation cannot last indefinitely. Over recent decades the rapid growth of the Chinese economy has allowed the Chinese state to manage the tensions between different class forces in society.

Many of the relatively new capitalist class are literally the children of Communist leaders, and almost all are members of the Communist Party. Nonetheless, their continued development could destabilise and undermine the current power of the Chinese ‘communist’ state. The developments of recent months are an attempt to prevent that. The curtailment of the private finance sector, for example, was primarily to prevent it beginning to undercut the role of the state banks. The measures against the property developers are an attempt to deflate the property bubble in an organised way and to cut across growing discontent about the unaffordability of housing.

The Chinese working class, now the most powerful in the world, has not yet made its voice heard as an organised force, although there have been important strikes. The development of capitalism in China has led to a gigantic increase in inequality. The reforms introduced after the revolution – such as security of employment and state provision of health and education – have been destroyed or, at best, massively undermined. However, unlike the capitalist west where workers’ wages have been squeezed for decades, overall living standards have increased up until now, which has enabled the regime to maintain a basis of support.

As the Chinese economy faces greater difficulties, not least as a result of US imperialism’s attempts to block its further development via trade barriers, class tensions are bound to increase dramatically. These will also be reflected within the giant Communist Party, with around 90 million members.

Even now, as the Economist magazine put it: “On the party’s left wing are neo-Maoists who have long agitated for a restoration of their hero, and have criticised Deng, whom they blame for such problems as corruption and inequality. On the right are those who worry (very privately) that China is sliding back towards a Mao-style dictatorship.” Xi currently seems to be balancing between these different wings of the Communist Party, at the same time as stepping up Chinese nationalism, particularly on the issue of Taiwan, and whipping up prejudice, especially homophobia.

Working class

At a certain stage a section of the capitalist class could move to openly mobilise against the Chinese regime’s limiting of their freedom to make profits unencumbered. They would attempt to mobilise the middle and working classes around demands for democracy and, for example, LGBTQ+ rights. In such a situation the Chinese regime, or a section of it, could be pushed to strike further blows against the capitalist class in order to try and shore up its base among the working class. Such a crisis may begin at the top, but would certainly lead to mass revolt below, although its character in the first stages may be confused.

Whatever the character of the coming revolt in China, long-term stability is, however, ruled out. Evergrande may not be the next Lehman Brothers moment, but it does point towards the future storms which will engulf China and will further destabilise capitalism worldwide.

The only force able to take Chinese society forward is the working class. The crucial tasks for the Chinese working class will be to develop its own organisations – including further steps towards the development of independent trade unions and of a mass party of the working class, armed with a programme for workers’ democracy, including defending the rights of all oppressed groups, linked to the socialist transformation of society.

This will require fighting for the nationalisation of the big private corporations and banks, combined with a programme of democratic workers’ control and management drawing together the state sector in a real socialist plan of production, and opening up a new chapter in the struggle for genuine socialism worldwide.